It was just another Spring day for Carole Hinders in the quiet lakeside town of Arnold’s Park, Iowa, back in 2013.

The 67-year-old entrepreneur owned and operated Mrs. Lady’s Mexican Food, a well-known community staple for almost four decades.

For years, Northern Iowans and passers-by could count on this restaurante Mexicano for sizzling spices, a cozy atmosphere, and the owner’s warm welcome. To add to the Midwest charm, Mrs. Lady’s regular customers, who had become the establishment’s second family, also knew that credit and debit cards were useless when the check arrived.

With only cash on the premises, management made regular trips to the bank for safekeeping.

While business was good, the Midwest restauranteur ran a modest ship, so her bank deposits remained below $10,000. She’d been doing it since the Carter administration and never thought anything of it.

But on May 22 of that year, while Carole was enjoying breakfast and crossword puzzles with her grandchildren, she heard a knock on the door.

It was the IRS, and they weren’t there to ask about her signature queso sauce.

We’ve become accustomed to the importance of properly claiming and managing our taxes, whether personal or for business.

We know the stiff penalties for tax evasion and heard the audit horror stories.

Still, we understand taxes help maintain our complex society and we require some kind of regulation and enforcement to ensure fairness.

However, with increased scrutiny of government spending and overreach over recent years, people are asking more than ever: Should we abolish the IRS? Can we abolish the IRS? What would be the consequences vs. rewards?

Argument: No! The IRS is Essential To Our Way of Life!

Taxes our essential to our country and the IRS is the agency responsible for that, but I see tons of people on the right who call it “authoritarian” and oppose any attempt to fund it or hire more employees to work there. I fully support funding the IRS. I think its a good investment. -majesticbeast67 on Reddit

Main Points for IRS Support

Critical Money Maker

Accountability

They Look Out For The Little Guys

Cans of Worms

Global Competition

Point #1: Critical Money Maker

The IRS does more than enforce tax law. It also collects taxes. To the tune of about $4.47 trillion in 2023 alone, funding essential services such as defense, healthcare, and infrastructure.

With income taxes accounting for roughly half of federal revenue, canning the IRS would severely damage our nation's short and long-term operations.

Point #2: Accountability

Most people pay what they owe and move on, but not everyone will hand over their fair share. In FY 2023, the IRS collected $31.9 billion in revenue resulting from half a million in tax return audits.

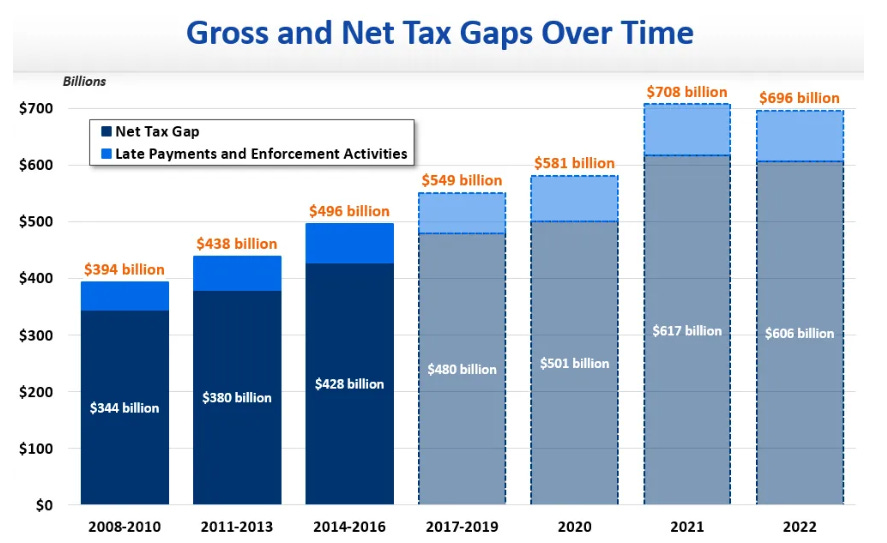

For context, the “tax gap,” or uncollected revenue from unpaid taxes, was $606 billion in 2022, down from $617 billion in 2021.

Point #3: They Look Out For The Little Guys

The IRS manages progressive taxation, so higher earners pay more than those on the lower end of the income spectrum. Without this system in place or federal oversight, lower-income people could suffer.

Point #4: Leave That Can of Worms Alone

Removing or replacing the IRS with another agency would require a complete overhaul of tax policy, leading to years of political strife. This would divert attention from higher-priority needs, and revenue collection could severely falter.

Practical challenges such as filling the federal income tax gap, legal battles, and economic disruption would prove overwhelming.

Point #5: Global Competition

The US isn’t the only nation with a federal revenue service. Here are a few examples from other first-world nations:

United Kingdom: HMRC

Germany: Federal Central Tax Office

France: Directorate General of Public Finances

South Korea: National Tax Service

Canada: Canada Revenue Agency

With most developed nations having IRS counterparts, abolishing ours could put the US at a significant disadvantage as the global community continues to manage income taxes and infrastructure maintenance.

Additionally, the IRS regularly collaborates with the Organization for Economic Cooperation and Development, a global agency that partners with 38 member countries to battle tax evasion.

Rebuttal: Get Rid Of It!

Abolish the IRS—a state-sanctioned extortion racket. @tyrannideris on X.

Main Points

Simplify and Amplify

Boundaries and Trust

Stress and Errors

Economic Growth and Savings

Moral Arguments

Point #1: Simplify and Amplify

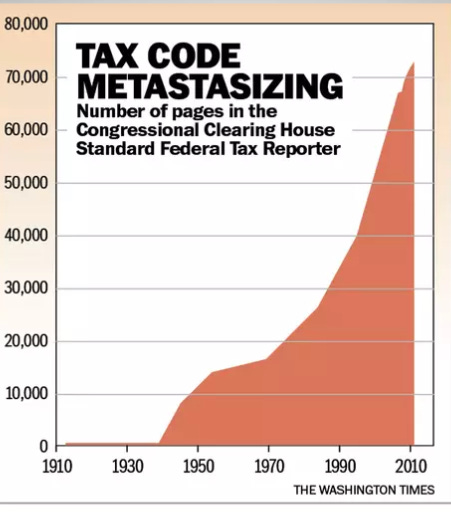

The tax code is confusing, even for people who deal with it for a living. With thousands of pages of evolving regulations, the IRS makes it difficult to stay on the up and up, even with the best intentions.

Abolishing the IRS would mean a more straightforward system with flat or national sales tax, reducing confusion and unnecessary bureaucracy.

In 2023, Congress proposed HR 25 to impose a 23% national sales tax on consumption instead of the standard income tax.

The proposal didn’t make it far.

Point #2: Boundaries and Trust

We’ve become way too comfortable with the IRS's power to legally audit, penalize, and seize assets. Often, citizens have little to no recourse, even when the government is at fault.

The agency isn’t known for its customer service, and it's not exactly trust-building when it employs a militarized enforcement arm complete with door-kicking tactical teams.

Few people have had positive experiences with the IRS, and Americans commonly see them as adversaries instead of an organization that helps and guides Americans through tax season.

Point #3: Stress and Errors

Taxes are stressful, even under the best conditions. Knowing you could lose your savings over a clerical error isn’t comforting.

Everyday Americans don’t have time for complex code and often don’t have the money to pay for pros to review everything. Especially when the government files charges.

Point #4: Economic Growth and Savings

If we didn’t have to hand over so much of our hard-earned money to the government, people could do wonders with the extra money by saving money or opening a business, which would boost the economy.

Countries like Singapore, the Cayman Islands, and the United Arab Emirates have booming economies despite low income taxes, as such conditions attract international business.

Point #5: Moral Argument

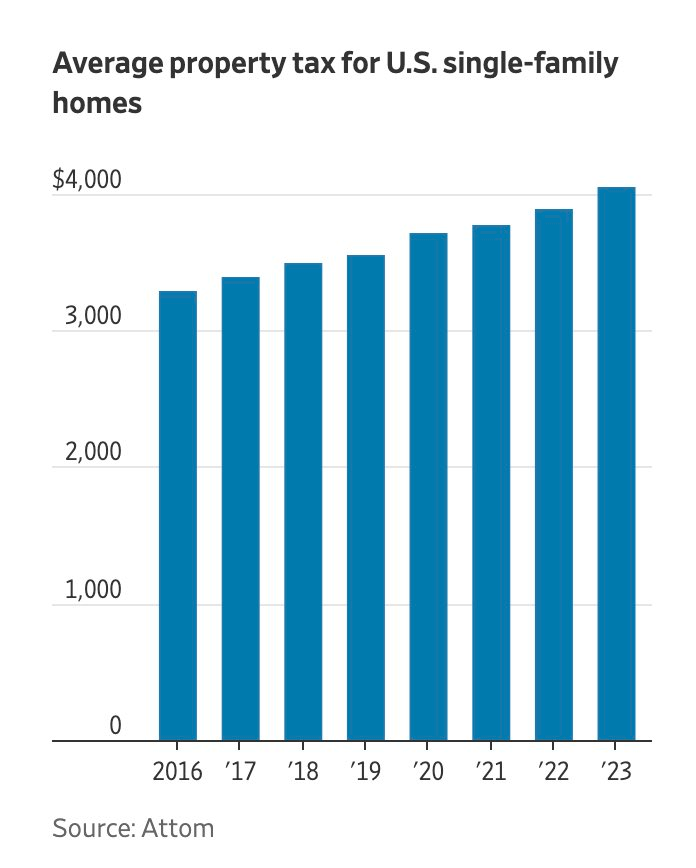

If you own your land, why must you pay property taxes? Sounds more like you’re renting it from the government. Call it what you want, but not paying up will result in guns at your door.

Does that seem right? How about the IRS's ability to invade your privacy and put your life on hold as they question every purchase you’ve made?

Most people cannot afford to fight the IRS, and again, lower-income people are more likely to incur irreversible damage.

Victorious Defeat

Carole set her crossword puzzle down, hushing her grandchildren as the knock at the door echoed through the house.

Maybe it was a neighbor, fundraiser, or Jehova’s witness. But she would’ve welcomed all three over what darkened her door: two IRS agents. Their badges felt like a gut punch. It’s concerning when you get a call or a letter from the IRS. A house call? This was serious. They must have the wrong house.

But the agents made no mistake.

After introducing themselves, they wasted no time delivering the haymaker: They’d seized her business bank account, flagged for “suspicious activity.” The crime? Regularly depositing cash under $10,000, a practice known as “structuring,” or actively dodging federal reporting laws.

Yet no agency charged her with a crime. Still, they stole her funds, totaling around $33,000, which she relied on for her survival, as did her staff.

Carole, a taco-slinging grandma with no criminal record, knocking on 70s door, scrambled to survive, borrowing money where she could and maxing out credit cards like a desperate gambler.

Thankfully, the Institute for Justice swooped in to assist by filing claims on her behalf, known as “US v. $32,820.56.” No, really.

After a year of court proceedings, the truth surfaced. Carole was no tax dodger. Just an everyday American caught in a web of red tape and bureaucracy.

Finally, in 2014, the IRS relented, surrendering her money. But the victory was bitter. The court costs totaled twice what the IRS stole.

After 28 years of honest work, supporting her family and the community Mrs. Lady’s ended on a tragic note.

After the 2015 case, the IRS shifted policy to only focus on cases with evidence of criminal behavior, which is progress, but shocking that wasn’t the case to begin with.

After the ordeal, Carole stepped out of the spotlight. Now at 79, she’s likely retired, living quietly near Spirit Lake and spending time with family.

Adding salt to the wounds, her bid to have legal fees paid out under the Civil Asset Forfeiture Reform Act was denied in 2016, concluding her legal chapter and any hope of seeing the money the government robbed her of.

But let’s take inventory.

We have a 70-year-old woman running an honest business. A place where blue-collared Americans came for Taco Tuesday, and girlfriends yapped over jumbo strawberry margaritas. Not exactly a place you’d find any Don Julio 1942 behind the bar or Wagyu beef burritos on the menu.

Yet without a shred of evidence or criminal record, the government still put a boot on her neck.

Why?

Some say it's a war on entrepreneurism. Others say the IRS is drunk on power.

But to abolish the IRS? Those funds keep the lights on with social security, Medicare, and defense. We could swap them for consumption taxes or state contributions, but such a feat would be messy, perhaps a pie in the sky.

If the IRS is to stay, it needs severe reform and a short leash.

Sadly, I didn’t have to dig deep for this story. What happened to Carole is but one nightmare of many for the American entrepreneur.

For the federal government, just another forgotten notch in their headboard.

Meme of the Week

Brand of the Week: Adventure Clothes Company

Since Catherine was a young girl, she had a knack for the “fiber arts,” learning the tricks of the trade from both grandmothers. Now, as a homemaker and mother of three kids, she’s continued the family tradition and woven a business of her own.

With every thread stitched with cotton-based fabrics milled in the US from her home studio in Central Wisconsin, Catherine spins up durable and comfortable hoodies, rompers, and beanies for women and children.

Go visit Catherine’s online store today!

Americans of the Week: Riley Howell

On April 30th, 2019, Riley sat in a classroom at UNC Charlotte when a gunman burst in and opened fire, killing two and injuring four.

Witnesses said Riley, an ROTC student, charged the gunman, tackling him and pinned him down long enough for others to run.

During the struggle, Riley took multiple fatal rounds, sacrificing himself to save his classmates.

Later, the Charlotte-Mecklenburg police confirmed that Riley’s actions saved lives. UNC posthumously awarded Riley the UNC Charlotte Citizen medal for his selfless service. Remember Riley today.